Incorporating hard cash straight to your account. Understand that contributions are subject matter to annual IRA contribution limits set by the IRS.

As opposed to stocks and bonds, alternative assets tend to be more challenging to provide or can feature rigid contracts and schedules.

After you’ve identified an SDIRA provider and opened your account, you may well be wanting to know how to actually start off investing. Being familiar with both The principles that govern SDIRAs, along with how you can fund your account, can help to put the foundation for your future of prosperous investing.

The tax benefits are what make SDIRAs desirable For numerous. An SDIRA is usually both conventional or Roth - the account sort you select will depend largely on your investment and tax tactic. Look at with your financial advisor or tax advisor in the event you’re unsure which is most effective for yourself.

Being an investor, however, your choices will not be limited to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Making essentially the most of tax-advantaged accounts permits you to maintain more of The cash which you invest and gain. Dependant upon regardless of whether you end up picking a conventional self-directed IRA or perhaps a self-directed Roth IRA, you have got the probable for tax-cost-free or tax-deferred growth, presented specific ailments are met.

Criminals occasionally prey on SDIRA holders; encouraging them to open up accounts for the objective of producing fraudulent investments. They frequently idiot buyers by telling them that Should the investment is approved by a self-directed IRA custodian, it should be legitimate, which isn’t genuine. Once again, make sure to do extensive due diligence on all investments you decide on.

No, you cannot put money into your own small business having a self-directed IRA. The IRS prohibits any transactions involving your IRA and your possess business since you, as being the operator, are regarded as a disqualified particular person.

Going resources from a person style of account to another type of account, which include transferring money from the 401(k) to a traditional IRA.

Should you’re seeking a ‘set and overlook’ investing system, an SDIRA most likely isn’t the best preference. As you are in total Handle in excess of every single investment created, It really is up to you to carry out your very own research. Remember, SDIRA custodians aren't fiduciaries and can't make tips about investments.

Confined Liquidity: Lots of the alternative assets which can be visit this page held in an SDIRA, which include real estate property, private fairness, more or precious metals, may not be conveniently liquidated. This can be a difficulty if you'll want to access cash quickly.

Certainly, real estate property is one of our clientele’ most widely used investments, often called a real-estate IRA. Clients have the option to take a position in every thing from rental Qualities, professional property, undeveloped land, home finance loan notes and much more.

Research: It is really referred to as "self-directed" for a explanation. With an SDIRA, you will be entirely responsible for thoroughly studying and vetting investments.

Therefore, they tend not to advertise self-directed IRAs, which offer the flexibleness to speculate in the broader selection of assets.

Feel your Close friend could be setting up the next Fb or Uber? With an SDIRA, it is possible to spend money on triggers that you think in; and potentially take pleasure in bigger returns.

Entrust can support you in acquiring alternative investments together with your retirement resources, and webpage administer the getting and promoting of assets that are typically unavailable by means of financial institutions and brokerage firms.

Ease of Use and Know-how: A user-welcoming platform with on the net tools to track your investments, submit documents, and control your account is important.

This contains comprehension IRS regulations, managing investments, and avoiding prohibited transactions that could disqualify your IRA. A scarcity of knowledge could result in high-priced problems.

Client Support: Try to look for a company that offers committed assistance, together with entry to professional specialists who can respond to questions about compliance and IRS regulations.

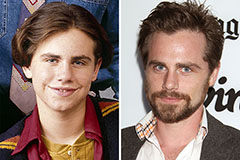

Rider Strong Then & Now!

Rider Strong Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!